Starting from the Beginning: Initial Coin Offerings (ICOs)

In 2016, ICOs started gaining traction within the blockchain and crypto community. The hype exploded exponentially, and by Q2 2017, the concept of ICOs and the desire for easy profits had spread to both VCs and average retail investors. More than $6 Billion was raised through ICOs in 2017. As 2017 came to an end, so did the unsustainable growth of the ICO market, and an inevitable market correction ensued. Hundreds of ICOs were caught performing exit scams and others were left with Ethereum (ETH) that they had raised, now worth less after the fall of crypto prices across the board. The year was a lesson for most crypto investors (many with no prior market experience); the ease of launching an unregulated ICO with no tested product or service, along with the lack of accountability for officers and involved parties allowed for unproven projects to be sold to unaware investors as the next paradigm. As investors cut their losses and looked to the future, a new model offered to solve many of the downsides of ICOs, allowing for increased regulation, full disclosure, accountability for the entity launching the tokens, and brand new value propositions.

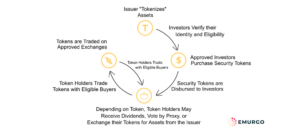

A Promising Solution: Security Token Offerings (STOs)

Security Tokens, unlike Utility Tokens (and tokens sold under the guise of Utility Tokens), are classified as financial products, meaning that they are regulated according to similar rules as securities (many countries use systems similar to the Howie Test for classification). Backed by tangible assets, they represent a share in profit, dividends, interest, or some other expected financial gain. They are regulated by the regulatory bodies that govern financial securities, and require compliance with financial securities law, approval, and/or licenses to be sold.

Accountability and Disclosure

The lesson from the ICO boom is clear: though blockchain offers great transparency into spending and smart contract construction, more structure is needed in terms of disclosure. As STOs in most countries require abiding by the same laws that govern the issue of financial products to the public (or to accredited investors), steps to satisfy disclosure requirements must be taken before selling any tokens. At a minimum this usually requires publishing or sharing an offering memorandum, more detailed than the typical buzzword-heavy ICO whitepaper. As countries typically require companies issuing security tokens to announce their intentions to sell securities (through a filing, public notice, or application), the directors of the company are on file and can be held accountable if they do not act in the best interest of the investors. This makes it unlikely that a company “exit scam” or use funds for purposes different from those which were specified in the offering memorandum.

Increased Efficiency Through Programmable Compliance

Compliance has traditionally been a headache in finance. Actions such as selling or transferring shares of a company to another individual may require many compliance steps. The blockchain offers not only an immutable way to keep track of ownership, but also allows for the streamlining of compliance by hard-coding restrictions and rights directly into the smart contract of the Security Token. Examples of potential programmable compliance include lockup periods and identity verification requirements. As compliance is further automated, the costs of primary issuance and secondary trading and transfers will likely drop significantly.

Other Advantages

Other advantages of Security Tokens include automated dividend distributions, simple proxy voting, fractional ownership of high-value assets, increased liquidity with no closed market hours, and a flexible nature.

Where’s The Market Headed?

Though nobody knows where the market is headed, we can illustrate some numbers. There are unlimited potential use cases for security tokens. The global equity market is estimated upwards of $80 Trillion, not including the even greater real estate market. This represents a huge opportunity, not only for the tokenization of existing assets, but for the creation of new investment types and vehicles that span across both traditional and new markets.

The inefficient world-wide market is ripe for disruption; billions are spent yearly on paper accounting with many unnecessary parties involved. With STOs promising trust equal to that of the traditional stock market, along with the increased transparency and programmability of smart contracts on the blockchain, it is only a matter of time until a more efficient model replaces the traditional model.

What is EMURGO’s positioning for STOs?

EMURGO as the official commercial arm of Cardano, has been gaining a strategic position for the upcoming era of Security Tokens as STOs display tremendous synergy and align with the value proposition of Cardano – a scalable, sustainable, and interoperable third-generation blockchain with a research-first driven approach.

In January 2019, EMURGO announced an anchor investment into Y2X, a leading digital merchant and investment bank that will help entrepreneurs raise capital for expansion through Securities Token Offerings and other means with Cardano becoming the protocol of choice for Y2X and its portfolio companies. Y2X was co-founded by J. Todd Morley, a co-founder of Guggenheim Partners and David Shuler, former Managing Director at CME Group.

EMURGO has been in the public view speaking on the future of STOs at numerous blockchain conferences including Japan Blockchain Conference to inform the public about STOs and the value it provides to existing verticals.

What’s Needed?

The digital securities market, like any new market, faces the challenge of balancing adoption with the development of infrastructure and the navigation of existing laws and regulations. As legislators define the rules surrounding digital securities and Security Tokens, and an efficient ecosystem is built and tested by first movers, adoption will follow. For more thoughts on regulation and the challenges facing security tokens and STOs, see STOs: Reconciling the Immense Potential with Global Legislation.

Conclusion

If you are a business looking to launch a STO or a proper ICO, EMURGO, the official commercial arm of Cardano, is here to help! Our mission is to help businesses’ looking to get involved within the blockchain industry and to support projects within the Cardano ecosystem. Navigating the preparation of an ICO or STO can be difficult so get in touch. Our consultants understand country-specific regulations and have years of experience working with PR, community support and produce marketing strategies and assets which provide businesses with the best possible outcome of success when launching an ICO or STO.

EMURGO drives the adoption of Cardano and adds value to ADA holders by building, investing in, and advising projects or organizations that adopt Cardano’s decentralized blockchain ecosystem. EMURGO leverages its expertise in blockchain R&D as well as its global network of related blockchain and industry partners to support ventures globally.

EMURGO is the official commercial and venture arm of the Cardano project, headquartered in Singapore, with a presence in Japan, the USA, India, and Indonesia. EMURGO works closely with IOHK and The Cardano Foundation to grow Cardano’s ecosystem globally, and promote its adoption. Learn more about the project at https://dev.indonesia.emurgo.io

|| Click here to subscribe to the EMURGO Newsletter ||

Follow EMURGO on Social Media

・Official Homepage: dev.indonesia.emurgo.io

・Twitter (English): @emurgo_io

・Twitter (Japanese): @Emurgo_Japan

・Youtube: EMURGO

・Telegram: EMURGO Announcements

・Facebook: @dev.indonesia.emurgo.io

・Instagram: @emurgo_io

・LinkedIn: @emurgo_io

About Yoroi Wallet

・Yoroi Twitter: @YoroiWallet

・Yoroi Homepage: https://yoroi-wallet.com/

About Cardano

・Cardano Forum: https://forum.cardano.org/

・Cardano Telegram: https://t.me/CardanoGeneral

・Cardano Reddit: https://i.reddit.com/r/cardano